How does a glorified hobby evolve into a six figure business? I’d like to tell you that it was the product of a childhood dream plus decades of planning come to fruition. But to be honest, teenage me would be shook by the unlikely direction my life and career have taken.

Growing up, my parents espoused the principles of simple living and led by example. For my family, this didn’t mean living off the grid, homeschooling and cultivating organic kale. It meant prioritizing family time, freedom and self-actualization over the material trappings associated with “success”. It meant forgoing career opportunities in the big city in favor of working flexible hours in our small town. It meant canoe trips, bagged lunches and backyard games instead of amusement parks, restaurants and cable TV.

My only semblance of teenage rebellion was briefly straying from my family’s simple living values. There was a time when I would have proudly told you that making my fortune was motivating and important to me. It wasn’t until I came upon a fork in the road that I was forced to ponder these values for myself.

In my third year at Queen’s University in 2011, I was invited to meet with a partner from a multi-billion dollar private equity fund that had donated one of my scholarships. Over lunch, I learned that his firm recruited math and physics students and I was offered an internship on the spot. At the time, this seemed like the golden ticket to wealth I had craved. But something gave me pause. After mulling over the offer, I ended up choosing a different path for many reasons, ultimately turning my back on a conventional career.

I had almost forgotten about this anecdote until the past year. I finally had a small taste of the financial success I had once coveted and, admittedly, I found it addictive. For a time, I again lost touch with the value of simple living. My orientation towards triathlon also shifted. I’ve always been pragmatic about racing and the business side of the sport, but I caught myself cynically eyeing up opportunities on the basis of earnings alone.

One of the many lessons of the past year is that money can’t sustain passion and enthusiasm and it sure as hell isn’t what inspired me to pursue professional triathlon.

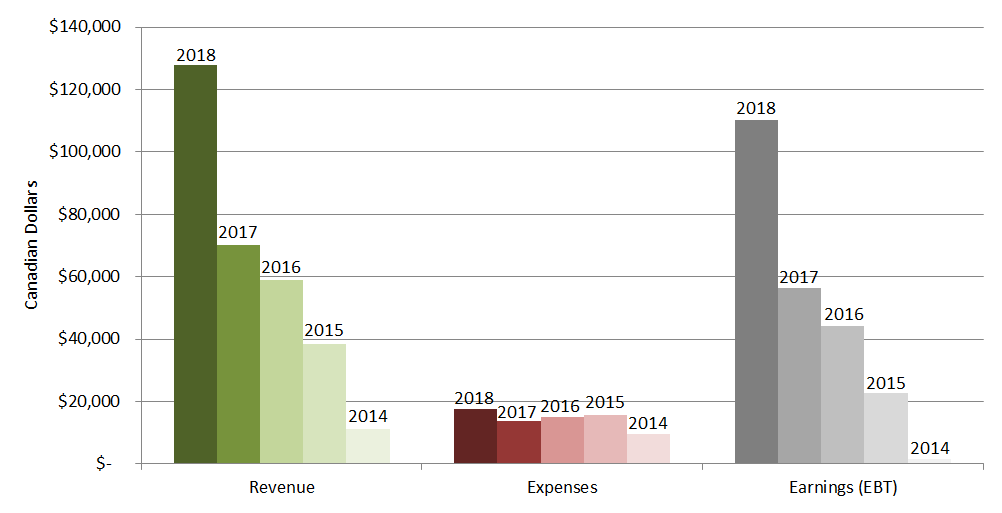

My Fourth Year Pro Triathlon Budget

My Third Year Pro Triathlon Budget

2018 Retrospective

2018 was the best year of my life by almost any measure. I won five races, nailed my IRONMAN debut, and made more money than the past two years combined. I also finally closed on my first house, wrapped up my overambitious home reno (well mostly) and my boyfriend moved in with me. Things were going swimmingly.

However, as much as I enjoyed the ride, that success was also a double-edged sword. For all the excitement of the past year, there were also some tough lessons which caught me off guard. In my soul-baring essay, “Growing Pains,” I wrote about my struggles with anxiety and perfectionism, exacerbated by the newfound pressure, expectation, overcommitment and scrutiny that I experienced. Over the off-season, I was almost as miserable and reclusive as my years in university. I even questioned whether the brutality of IRONMAN training had somehow rewired my brain and predisposed me to anxiety.

Earning more money was also unexpectedly stressful in its own way. First world problems, anyone? I spent more time than ever managing sponsor contracts, bringing my bookkeeping up to snuff, investing and filing tax returns in multiple countries, all by myself. I was adulting hard.

I also debated whether I should continue the annual tradition of publishing my finances following a point raised in an interview. The question was whether I would risk alienating or annoying some readers now that my income was more than double the Canadian median. An ironic fact about triathlon is that your average amateur handily out-earns the vast majority of pro triathletes (see USAT’s membership demographics). After all, triathlon is the new golf! On the other hand, some of my readers are struggling millennials or penniless athletes chasing Olympic dreams. Perspectives will vary.

Let’s also recall that I barely broke even in my rookie pro season after years as an amateur. So my average hourly rate in triathlon still makes Walmart’s compensation package look positively lavish!

Wherever you stand, my intent with these posts is to uphold my reputation for transparency, to inform and dispel misconceptions, and maybe even to inspire.

2018 Budget

Revenue, expenses and earnings before taxes (EBT) from triathlon over my five years as a professional are summarized below. Throughout this post, I’ll give dollar figures in both Canadian and US dollars (converted at the average annual exchange rate) since the majority of my revenue and expenses are in US dollars though I live in Canada.

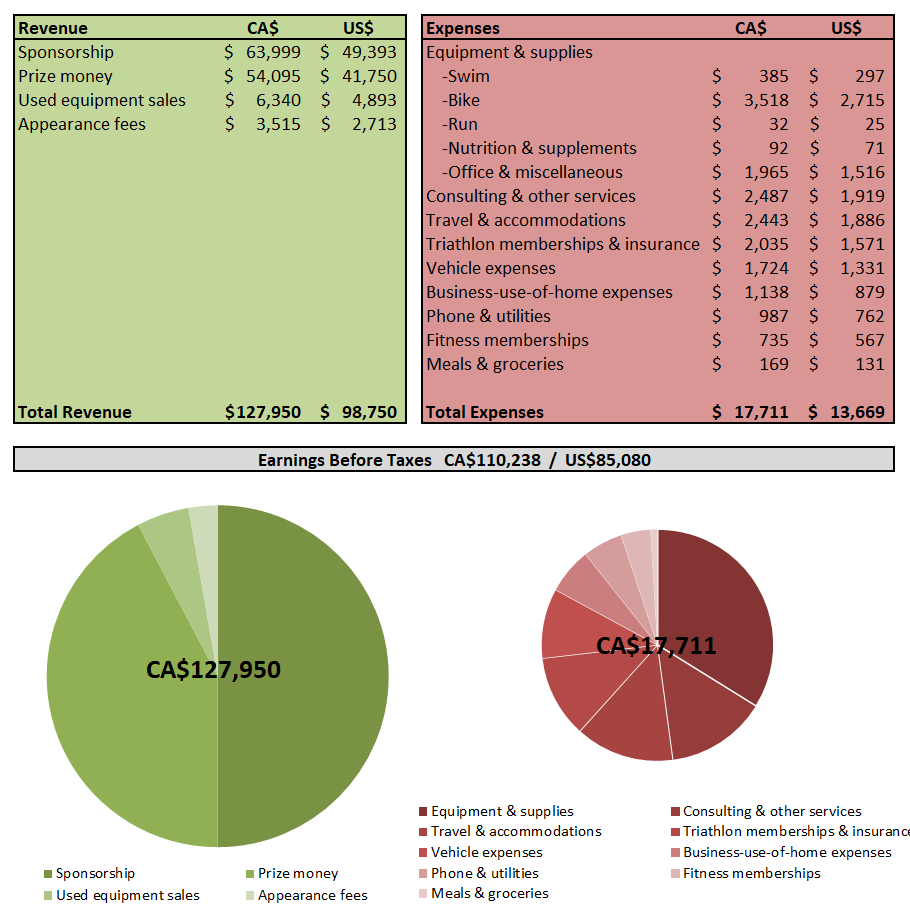

A detailed breakdown of my 2018 triathlon budget is shown below. Like previous budgets, this one strictly includes triathlon-related revenue and expenses. Non-triathlon income and expenses are discussed later.

Revenue

Prize Money

I made more in prize money in 2018 than any previous season despite racing less often. Other than a flat tire in Texas and an off day in Monterrey, I managed to consistently execute some of my best performances. Prize money amounts below are in US dollars and include any amounts subject to foreign tax withholding*.

- 1st IRONMAN Chattanooga: $15,000*

- 1st IRONMAN Mont Tremblant: $12,000

- 1st IRONMAN 70.3 Eagleman: $6,000*

- 1st IRONMAN 70.3 Victoria: $5,000

- 1st IRONMAN 70.3 Taiwan: $3,000*

- 7th IRONMAN 70.3 Monterrey: $750

- 22nd IRONMAN 70.3 Texas: $0

- Total: US$41,750 / CA$54,100

Sponsorship

Cash sponsorship accounted for the greatest share of my income in 2018 at CA$64,000, up over 60% from 2017 and about 440% from 2016. I saw growth in both performance bonuses and base salaries. More reliable fixed income allowed me to focus on top performances at fewer races.

I’ve written a good deal about sponsorship in previous editions of my budget and I have only a little to add this year. Generally, sponsorship compensation can take several forms, listed below. Only the first two categories are directly accounted for in my budget. I also had strong returns in the equity stake I acquired as compensation from a sponsor, making it one of my most lucrative deals.

- base salary/stipend

- performance bonus

- expense allowance (e.g. covering travel)

- equity

- product

- exposure & other services

I view sponsorship with the same mentality behind a diversified investment portfolio. I aim to have contracts featuring compensation from a balanced mix of these categories. I also seek a combination of endemic (triathlon industry) and non-endemic (non-triathlon) sponsors. This balanced portfolio hedges against fluctuations in both my performance and the state of the triathlon and broader endurance sports industries.

I set a cap of 8 to 10 sponsors, which is the maximum I can realistically maintain without some unacceptable compromises. As a result, I’ve become very up front about what I can offer and what compensation I expect in return. It’s well worth my time to carefully research and vet prospective sponsors. Only about one in ten opportunities actually pan out, so I’ve learned to say no thanks and to accept rejection.

Financial compensation is only one piece of the puzzle. A respectful rapport, reasonable expectations, and a long-term commitment are more important to me than the money on the table.

That said, I generally don’t accept product-only deals. I would rather purchase my ideal products without any concessions or strings attached. I’m astounded by what some athletes—pros and age groupers alike—are willing to do for a little free product. In my opinion, this does the industry a disservice and inundates social media with low quality advertising. I do my best to disclose sponsored content and to only partner with companies that I truly respect.

I’ve continued to work with an agent, Claire Duncan. I enjoy managing the bulk of my contracts, though Claire has been very helpful with negotiations and introductions. Some doors simply aren’t open to a self-represented athlete, particularly larger corporate opportunities. It can also be challenging to protect my interests in periodic negotiations with sponsors with whom I maintain a close and friendly rapport. Claire, on the other hand, can play hardball. In many ways, an agent helps free up my mental bandwidth.

Non-Triathlon Income

For the fourth consecutive year, most of my income came from triathlon. I drew on some investment income over the first part of the year to fund the remainder of my home renovation. I also received what will likely be my last paycheck from from the environmental science consulting firm that I worked for since 2011. I’m very grateful for this engaging work that afforded me the flexibility to pursue pro triathlon.

Expenses

Here’s a breakdown of how I spent money in 2018, rounded to the nearest thousand dollars and guesstimated in some cases. Note that despite paying tax in three countries, my income tax rate was relatively low due to a large Registered Retirement Savings Plan (RRSP) contribution.

- Savings: $37,000

- Living expenses: $26,000

- Income tax: $20,000

- Triathlon expenses: $18,000

- Home renovations: $15,000

- Home furnishings: $10,000

- Entertainment & vacations: $3,000

- Miscellaneous: $2,000

- Total: ~CA$131,000 / ~US$101,000

Triathlon Expenses

Triathlon expenses appear to be higher than previous years, though in reality this increase reflected more efficient use of tax deductions and better bookkeeping. For the first time, I claimed a fraction (~10%) of qualifying home expenses since I effectively run my business out of my house.

Travel expenses were half of the previous year due to a shorter race schedule and the generosity of Giles Atkinson, one of my earliest supporters. Earlier in my career, I would scrimp on travel wherever possible. This led to some traumatic character building experiences (avoid the $30/night hotels!). Statistics suggest that the amount I’m willing to pay to avoid a red-eye flight goes up by $100 every year. I’m getting too old for that shit!

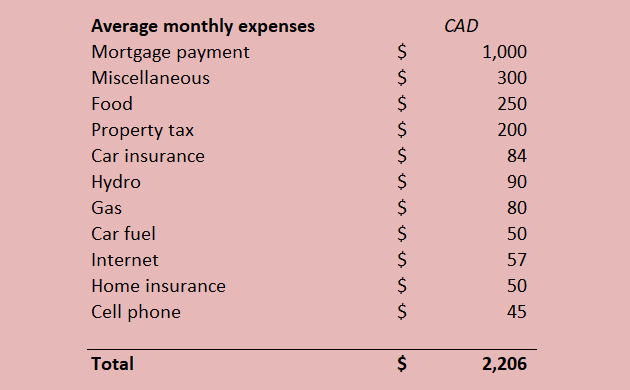

Living Expenses

In every edition of my budget, I’ve made reference to my thriftiness and financial restraint (“pathological cheapness” in the words of my dad). Years of scrimping and saving, including returning to live with my parents for three years after university, set me up to buy my first house—an 1890s fixer upper in downtown Guelph. After a nightmarish year of delays and renovations, I finally moved in in early 2018.

Last year, I noticed a shift in my spending habits. Something about having more cash on hand and dealing with unfamiliarly large sums during renovations began to erode my financial discipline. I didn’t exactly trade my Prius for a Lambo, and I still can’t stomach buying $9 loaves of artisanal peasant bread like my parents, but my expenses definitely began to creep up. For example, online shopping for home improvement and decor became a guilty pleasure. To combat this creeping consumerism and stay true to my minimalist roots, I took small steps like challenging myself not to buy any new clothes for the entire year.

Even so, my living expenses remained well within my means. I questioned whether I should have bought a fancier house, but decided that I was more comfortable with my modest mortgage (~CA$180,000) and the flexibility and peace of mind that affords. The common practice of taking on the largest possible mortgage and living house poor because real estate is lauded as a “good investment” feels like collective insanity fueled by the promise of growth from a bygone era.

My average monthly living expenses are itemized below, excluding major planned expenditures such as home renovations, furniture and vacations.

My boyfriend of four years, James, moved in with me last year before renovations were even complete. James just graduated from the University of Guelph, therefore we had to come up with an equitable financial arrangement to address both our income disparity and the fact that our home is technically my asset. Many of my millennial friends find themselves in similar financial situations with their partners. Our arrangement is that James contributes about CA$500 per month towards shared expenses plus a portion of our grocery and internet bills. This is fair market rent for a bedroom in a student rooming house and roughly one quarter fair market rent on a home like ours. If and when James has the capital and the inclination to put money towards the mortgage or upkeep, we’ll come up with a new arrangement.

Saving & Investing

I’m not exactly passionate about investing, despite my penchant for financial planning. I grudgingly stay informed by following several blogs and subreddits. I aim for a relatively hands-off investing strategy and resist reacting to market movement.

I learned some valuable lessons about investing over the past couple years. I got my start as a teenager investing exclusively in exchange-traded funds and index funds, a proven—if a little boring—approach. After a decade of solid returns during a prolonged bull market, I decided to get fancier. In my first foray into stocks, I tripled my investment in cannabis stocks within a year, timing the market with near perfection. Emboldened by what was mostly dumb luck, I hunted for the next big thing and found cryptocurrency. You can guess how this ended up! Mercifully, I limited my “fun” risk-taking picks to a tiny fraction of my portfolio, making this a relatively cheap but effective lesson in market dynamics and principles of investing.

My current asset allocation is roughly 35% Canadian ETFs, 34% US ETFs, 30% developed and emerging international ETFs, and 1% cryptocurrency (excluding my equity in a sponsor). I don’t currently hold any fixed-income securities, which some may consider a bold or foolish move. My rationale is that I’m still in my twenties and I don’t intend to touch these savings for decades, so I have plenty of time to recoup losses. I also maintain a healthy balance outside of investments in the form of cash, accounts receivable and eye-wateringly expensive triathlon equipment, which could cover living expenses for at least a year or allow me to buy the dip in the event of a recession.

Note: The registered accounts discussed here only apply to Canadians, though other countries have similar tax shelters.

I shifted from saving mostly within my Tax Free Savings Account (TFSA) to my Registered Retirement Savings Plan (RRSP, similar to the US 401k) this year. Without getting into the weeds, it tends to be more tax efficient to contribute to a RRSP than a TFSA when your income is high relative to other years. I maxed out my RRSP contribution room which lowered my average Canadian income tax rate by about 12%, saving me over $12,000 in tax. Going forward, I’ll aim to max out my annual contributions in both of these tax-sheltered accounts.

Concluding Thoughts

There’s an adage that athletes love to cite, something to the effect of “you learn more from failure than from success.” This platitude may offer some consolation in the face of disappointment, but it’s never resonated with me. 2018 was the most successful year of my life, yet it also carried some of the most humbling lessons and greatest personal and professional development. I was forced to contemplate my own definition of success. That’s still a work in progress, but I’m increasingly convinced that the success I care about most can’t be measured in dollars or wins or followers or magazine covers. I’m reacquainting myself with my motivations in triathlon, beyond the unpredictable external gratification and even more fickle financial rewards.